We are disclosing for the first time our gender pay gap in accordance with the UK Government regulators for gender pay gap reporting.

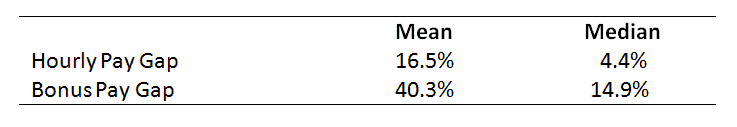

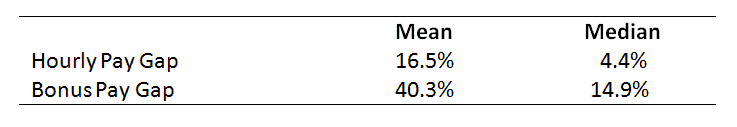

Our overall mean and median gender pay and bonus gap based on a snapshot date of 5 April 2017 (hourly pay) and bonus paid in the 12 months to 5 April 2017 is as follows.

Pay and Bonus – difference between males and females

Proportion of males and females receiving a bonus payment

Male: 78.8%

Female: 83.5%

Why do we have a gap?

The calculation behind the gender pay gap is not the same as equal pay. The underlying reason behind the gap is predominantly due to the structure of our workforce where there is a lower representation of women in senior leadership roles within our business.

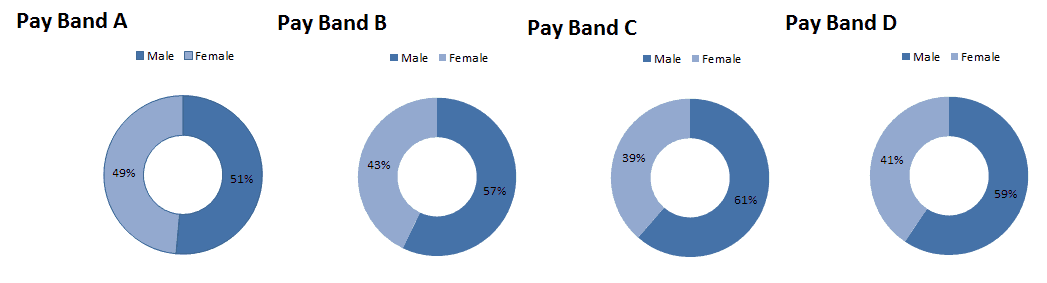

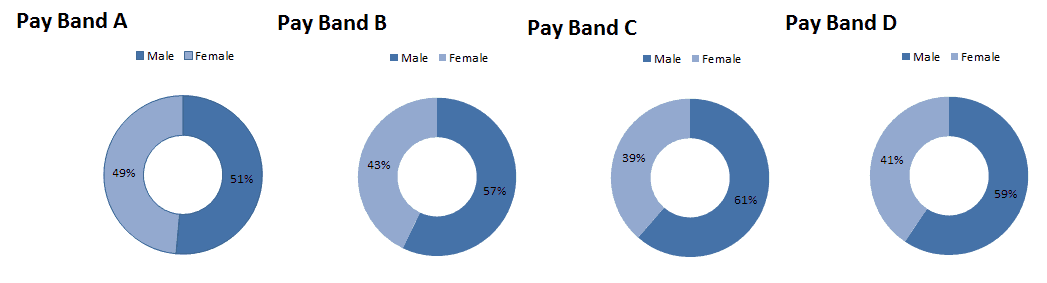

As seen in the quartile bands below, the gender mix shifts as we move towards the upper (higher pay) quartiles indicating that our mean gaps are significantly impacted by these imbalances. We recognise that female representation is lower in the upper quartiles and are committed to increasing the number of women in these bands.

We are confident that we do not have any processes or practices where people are being paid differently due to their gender. The gap in our mean figure relating to bonuses is due to the same reason that we have an hourly gender pay gap. Our senior workforce, which has a different bonus structure from the rest of the workforce, has a greater proportion of male employees. The equality of our pay structure is reflected in our median pay and median bonus figures which are not distorted by very large or small pay and bonuses – this shows a much smaller gap between males and females.

How are we addressing the gap?

The Office for National Statistics 2016 numbers put the mean salary gap at 34% for the financial services industry and whilst we understand our gender profile is typical of many financial services companies across the UK, we are committed to addressing this through a series of actions as follows:-

- Improving our recruitment targeting to ensure a diverse range of applicants are considered.

- Reviewing the structure of our workforce listening to our employees and improving our policies around diversity.

- Actively reviewing decisions around performance, pay and bonuses.

- Supporting employees through flexible working and professional development.

- Delivering tailored plans to promote gender diversity across the Group and supporting female progression into senior roles.

Gender mix by pay quartile (each containing at least 70 employees and quartile 1 being the lowest and quartile 4 being the highest)

Whilst we acknowledge we have a gender pay gap, we are clear on why it exists and are focused on the steps we need to take to close the gap.

I, Miles Cresswell-Turner, CEO, confirm the information in this statement is accurate.

Signed:

Dated: 03/04/2018